Renters Insurance in and around Hermiston

Looking for renters insurance in Hermiston?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a house or a condo, protection for your personal belongings is a good idea, even if your landlord doesn’t require it.

Looking for renters insurance in Hermiston?

Your belongings say p-lease and thank you to renters insurance

Why Renters In Hermiston Choose State Farm

Renters often don’t realize that their landlord’s insurance only covers the structure. Just because you are renting a townhome or apartment, you still own plenty of property and personal items—such as a smartphone, tool set, couch, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why get renters insurance from Jesse Torres? You need an agent who is dedicated to helping you understand your coverage options and choose the right policy. With efficiency and dedication, Jesse Torres is here to help you discover the State Farm advantage.

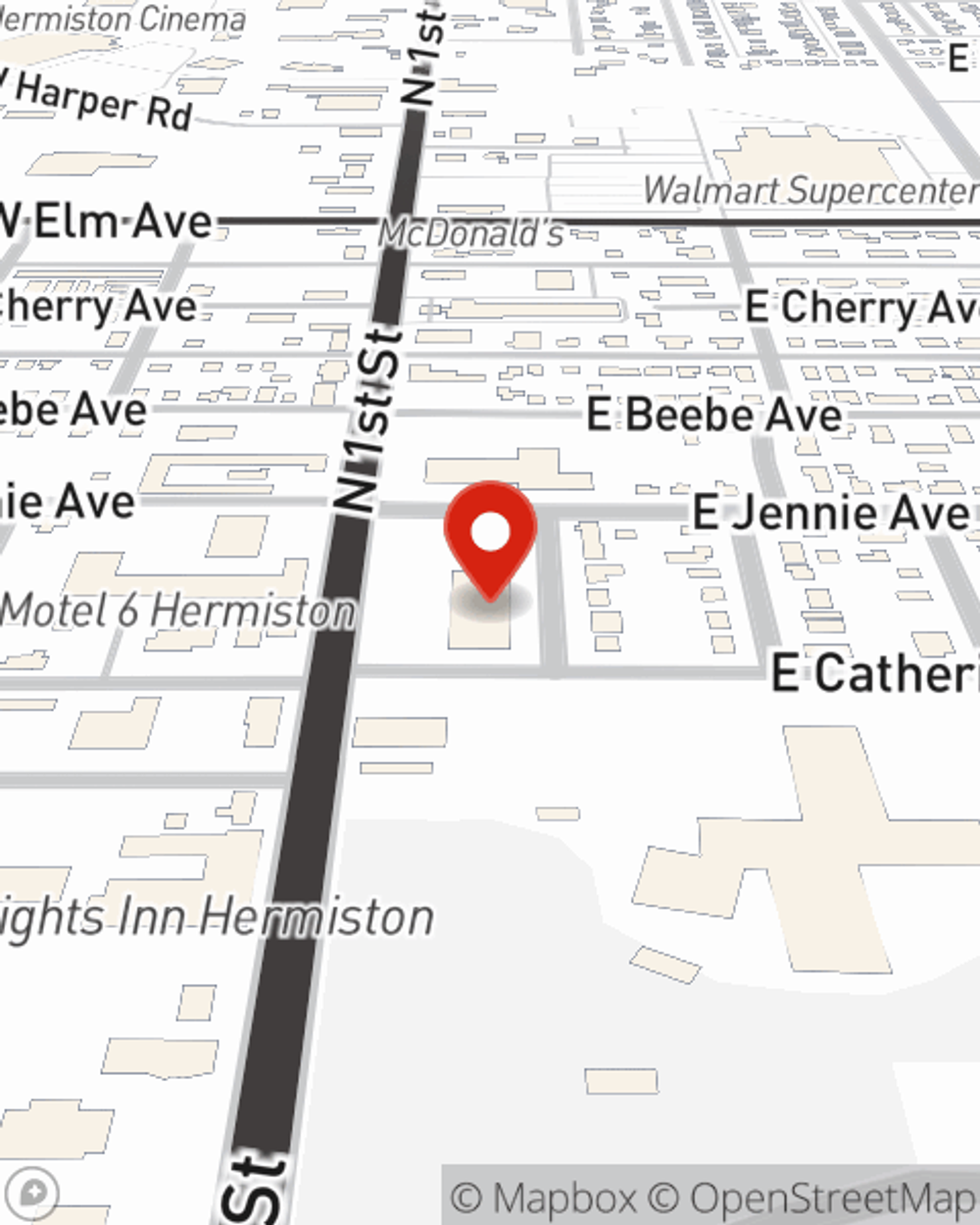

Don’t let the unknown about protecting your personal belongings stress you out! Get in touch with State Farm Agent Jesse Torres today, and learn more about how you can save with State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Jesse at (541) 567-1551 or visit our FAQ page.

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Jesse Torres

State Farm® Insurance AgentSimple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.